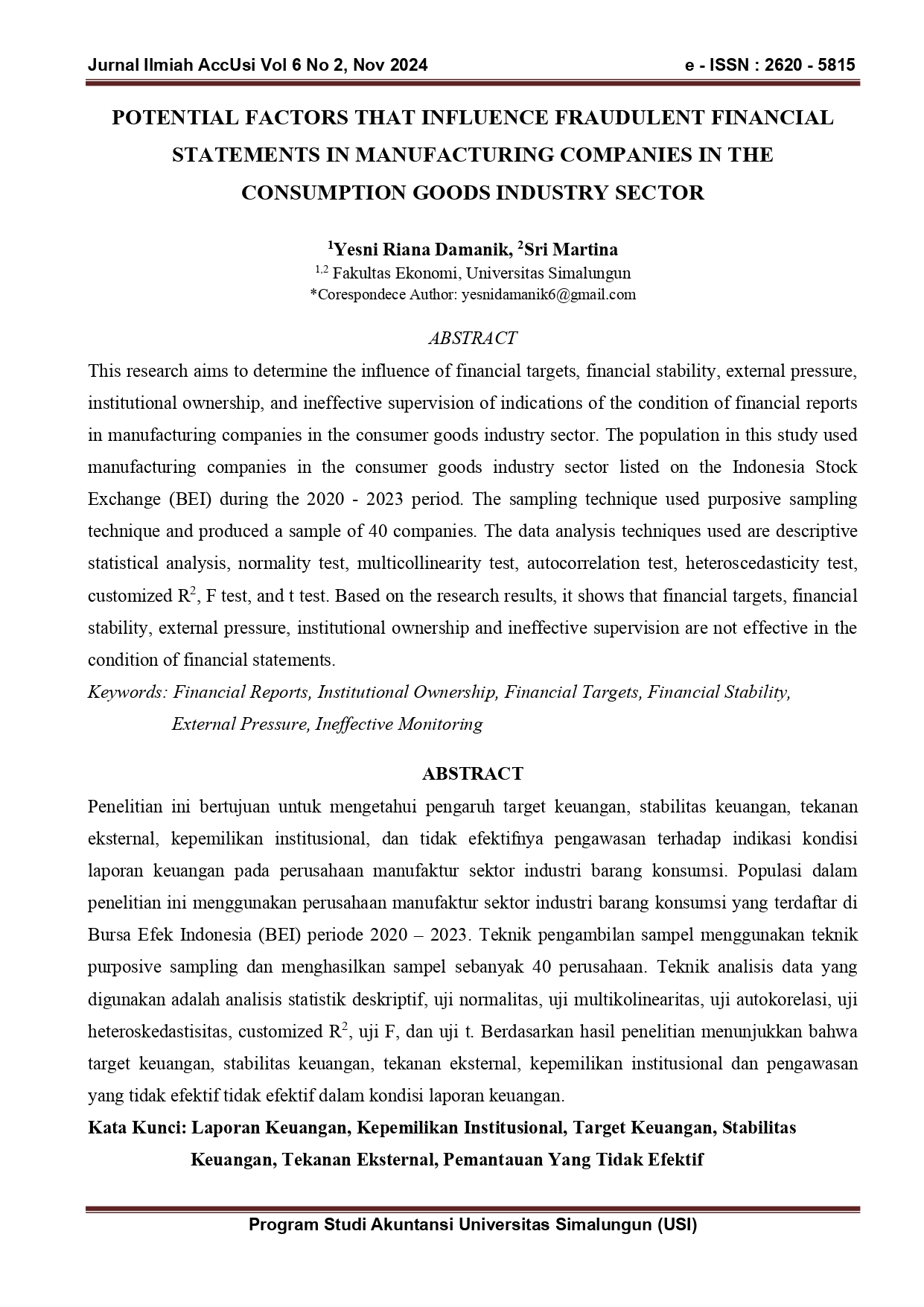

Potential Factors That Influence Fraudulent Financial Statements InManufacturing Companies In The Consumption Goods Industry Sector

DOI:

https://doi.org/10.36985/exvgtz11Keywords:

Financial Reports, Institutional Ownership, Financial Targets, Financial Stability, External Pressure, Ineffective MonitoringAbstract

This research aims to determine the influence of financial targets, financial stability, external pressure, institutional ownership, and ineffective supervision of indications of the condition of financial reports in manufacturing companies in the consumer goods industry sector. The population in this study used manufacturing companies in the consumer goods industry sector listed on the Indonesia Stock Exchange (BEI) during the 2020 - 2023 period. The sampling technique used purposive sampling technique and produced a sample of 40 companies. The data analysis techniques used are descriptive statistical analysis, normality test, multicollinearity test, autocorrelation test, heteroscedasticity test, customized R2, F test, and t test. Based on the research results, it shows that financial targets, financial stability, external pressure, institutional ownership and ineffective supervision are not effective in the condition of financial statements

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2024 Yesni Riana Damanik, Sri Martina (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.